Mastering Customer Retention Strategies for Business Growth

Last updated on Mon Oct 14 2024

Have you ever heard of the Pirate Metrics funnel by Dave McClure? It’s a reminder of the five areas you need to cover to keep customers happy and improve your growth strategy. These 5 areas are listed out below:

A – Acquisition

This is your first touch-point with customers: where they come from, and your brand’s first impression.

A – Activation

This is the tipping point where a customer tries your product for the first time. This is the make-or-break period.

R – Retention

Over here, you have to know what tactics to focus on in order to retain customers. This is also known as customer success.

R – Referral

This is still the best form of marketing—sorry, TikTok, you’re not there yet. Word of mouth is arguably the best form of marketing.

R – Revenue

This is the monetizing aspect. At which point does someone start to pay for your services instead of using a free trial?

Customer retention tactics play a role throughout the Pirate Metrics funnel, and they are uniquely measured. It's good to look at your overall strategies before examining specific retention techniques.

The good news is that there are retention measurement equations—like churn rate—that help you apply ROI to retention strategies. If you're curious about strategies to lower this rate, check our guide on reducing customer churn.

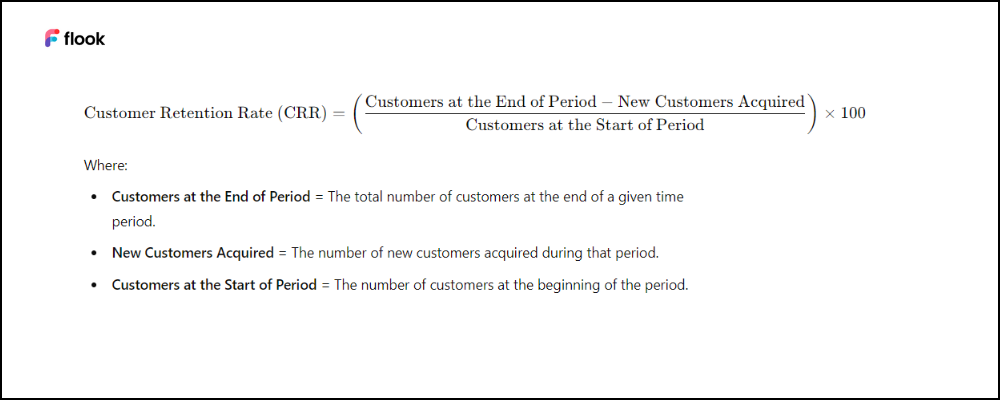

Customer Retention Rate Formula

Select the period you want to measure.

Collect the number of customers you had at the start (S), at the end (E), and new customers added.

Calculate:

(E−N)/S×100 = (E - N) / S x 100 = (E−N)/S × 100= your retention rate.

To make it easier, you can also use a Google Sheet to calculate it. If you need to convince a stakeholder to focus on retention instead of acquisition, show them the numbers.

Why Is Customer Retention So Important?

There’s a ton of research showcasing the financial benefits returning customers bring. However, there are a lot more benefits to customer retention. In this article, we will be exploring some of them right here.

Retention Aids Referrals

Having long-term customers gives social proof and is evidence of commitment. This can lead to referrals because people will be more interested in something you have shown commitment to. They will want to stick around so that they can get the value you are getting as well.

It Reduces Acquisition Costs

It is more cost-effective to keep existing customers than to get new ones. This is because existing customers who have used your products before will be more obligated to try out newer products without you having to do expensive marketing advertising. However, acquiring new customers would incur a lot of costs as you would need to do marketing and advertising. Hence, by focusing on customer retention you can save a lot of cost. For more on managing these costs, see our breakdown of digital signage costs.

Happy Customers Are Profitable Buyers

According to statistics, customers spend 31% more with a brand if they’ve bought from them before. When you focus on customer retention, you not only end up keeping your customers but you also end up selling more and getting more profit.

It Boosts Employee Morale

Last on our list, but not least, client retention promotes employee morale. It shows that customers trust your products, services, and overall mission. This trust would reassure your employees that their hard work and decisions are valued and making a difference. Because of this, employees feel more motivated and validated, knowing their efforts are contributing to the company's success and helping to build strong customer relationships.

What's a Good Customer Retention Rate?

Retention rates vary by industry, and you can measure them in two ways:

You can compare your product’s retention rates to competitors or similar businesses.

You can measure your product retention rates over your own past performance to track improvement.

Industry-Specific Retention Rates:

Different companies have different benchmarks for retention. Some industries have much higher rates, while others have lower ones.

According to *ChartMogul ,* the leading industries are:

Telecom:

78%

SaaS:

68%

Banking:

75%

IT Services:

81%

Commercial

Insurance:

83%

Professional Services:

84%

Media and entertainment:

84%

If you're in the SaaS industry, a retention rate over 35% is above average—it's a solid rate. To improve from above-average to much higher rates, you can analyze past data and set Key Performance Indicators (KPIs) to measure your progress.

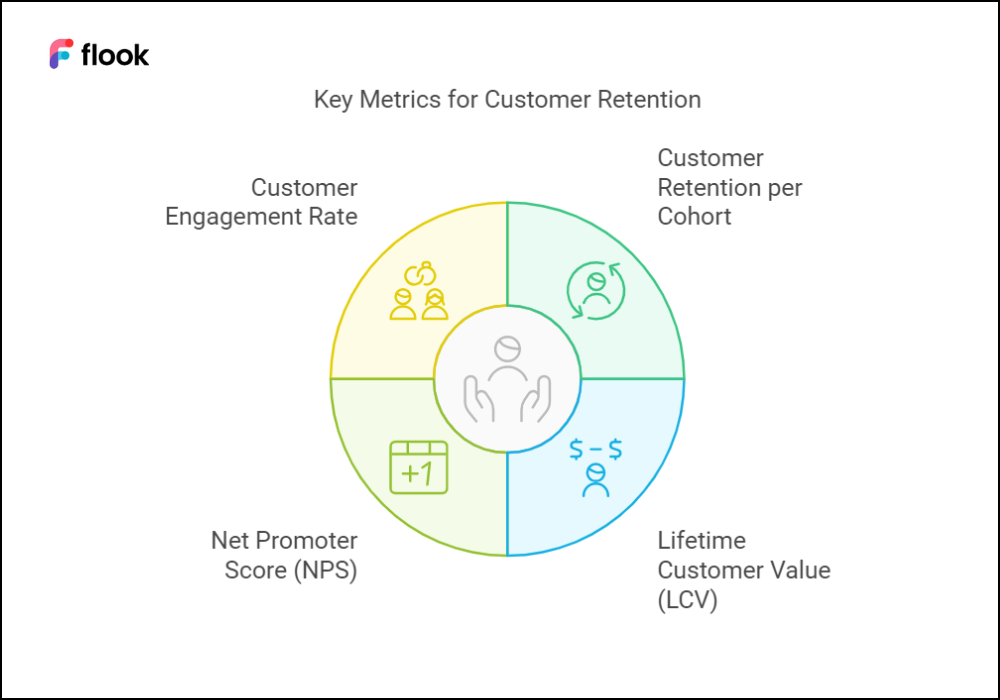

4 Key Customer Retention Metrics to Learn

There are many customer retention metrics but the one you use depends on your industry. Let's dive into four that could change the game for your SaaS retention strategies.

1. Customer Retention per Cohort

Cohort analysis is a method for tracking groups of customers (cohorts) over time to observe retention and churn (the rate at which customers stop using a product).

In other words, it helps businesses identify trends in customer behavior after onboarding and allows them to see how retention rates change over specific periods, like weeks or months. Separate users into cohorts by start day or week for retention rates per week/month. Here's a breakdown of trends shown by cohort analysis:

A Trend in Plateaus

This occurs when customers in a cohort stop leaving and start staying. It indicates that they’ve hit the point where they find value in the product and are likely to continue using it.

A Definite Churn

If a cohort shows complete churn (where all users eventually leave), it highlights a major issue with the product that needs to be addressed. It means that your customers aren't finding enough value to stick around.

A Trend in Drastic Churn

This helps you find specific moments in your product life cycle where many customers leave. It helps you identify problem areas during certain stages of your product lifecycle.

How To Improve Retention With Cohort Analysis

Cohort analysis helps you minimize the time it takes to get a customer to their value point in your product. When you understand what works for them, it helps you optimize it in order to help your users get there faster and consequently, build retention.

2. Lifetime Customer Value (LCV)

Your lifetime customer value shows you how much your business could make over time with a customer, i.e. for the entire duration of their relationship with your product. This helps justify your budget for lifecycle marketing and retention efforts.

The LCV Formula is:

SSA x RTA x RP = Average $ LCV

Where:

SSA (Sales per Average) = average amount a customer spends on each purchase.

RTA (Repeat Transactions Average) = number of times a customer makes a purchase.

RP (Retention Period) = number of years the customer remains with the business.

Take a look at this Example:

If a customer spends $50 on average, makes 12 purchases, and stays with the company for 6 years, the LCV would be:

$50 average x 12 transactions x 6 years = $3,600.

What Can You Do with This Data?

By analyzing this metric, you can assess ROI on acquisition and retention strategies. Consider these options:

Increase pricing

Increase retention period

It will be better to go for the second option because increasing retention will keep customers longer, generate recurring revenue and help reduce churn.

How to Improve Customer Lifetime Value?

To enhance this metric, initiate customer loyalty programs or give free samples to long-standing customers. Personalize their experience beyond acquisition.

3. Net Promoter Score (NPS)

NPS is a popular method to gather customer feedback that supports product-led growth. It is a widely used metric to gauge customer happiness and loyalty. It entails asking customers how likely they are to suggest your product or service to others on a scale of 0 to 10. The level of detail matters depends on how much time customers commit to answering your inquiries.

What Can You Do with This Data?

NPS analytics show you how your customers see your business and what their loyalty levels are. This helps set the ground for referral marketing. Low NPS emphasizes the need for additional retention focus.

How Can You Improve Your NPS?

The surest way to improve your NPS is to address it by identifying opportunities for improvement. Make use of client input and follow up with actions that bring changes.

4. Customer Engagement Rate

Engagement is key for retention. This focuses on recognizing engagement trends between your customers and your product. This will help to prevent churn by resolving disengagement even before it happens.

Some important Engagement Channels to Track:

Product

App or Website

Email

Messaging/Chat

Webinars

Social Media

What Can You Do with This Data?

Collecting this data allows you to identify engagement rates, spot trends of decreasing engagement, and recognize disengaged customers. This is your chance to either re-engage them or learn why they’re leaving.

Other Customer Retention Metrics to Keep in Mind

We could dive into this topic longer—but that’s not the purpose here. If you want to see more, check our guide on how to reduce customer churn.

For now, let’s touch on two more metrics:

Downgrade Churn & Upgrade Growth

This helps you understand customers who downgrade or upgrade plans, using micro surveys to identify product friction.

Days Sales Outstanding(DSO)

Track the time between billing and receiving payments to gauge customer trust. A lengthy DSO suggests either a dissatisfied customer or someone indifferent to your working relationship.

Wrapping It All Up

Retaining customers is tricky. Before building a strategy, gather data showing its impact on ROI. A key takeaway is that retention hinges on managing customer expectations.

Manage expectations with a stellar onboarding process to introduce customers smoothly to your product. Create brand ambassadors that stick around for the long term.